Empowering Companies with Strategic Legal Advice

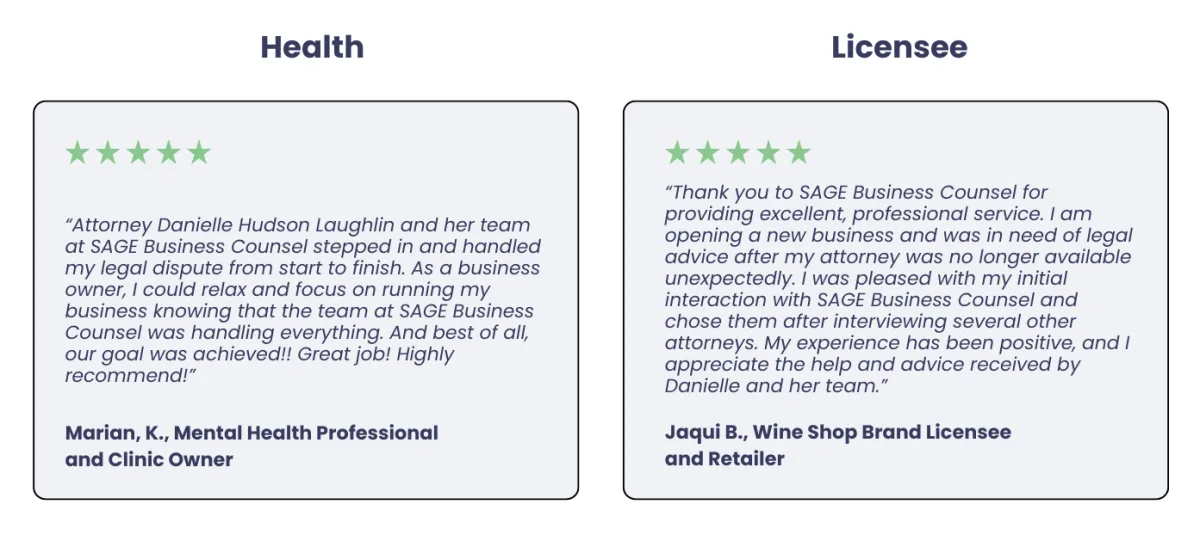

The best legal advisors are strategic allies in business. Learn how partnering with SAGE can transform legal frustrations into growth opportunities and help your company stay ahead of the competition. We specialize in Guiding Construction, Media, and SaaS companies—what we call 'Build-to-Scale' industries.

Empowering Companies

with Strategic Legal Advice

The best legal advisors are strategic allies in business. Learn how partnering with SAGE can transform legal frustrations into growth opportunities and help your company stay ahead of the competition. We specialize in Guiding Construction, Media, and SaaS companies —what we call 'Build-to-Scale' industries.

What Is The SAGE Advantage?

As fractional general counsel, we provide tailored legal solutions for construction, media, and SaaS companies. We help structure, scale, and safeguard scale-ups with proactive legal strategies. Here's how we can help your team:

Business Growth & Structuring: We can help your leaders scale with confidence through smart entity structuring and contract strategies that you get paid on time, every time. Cash is king, and flow is queen. We keep your company's growth engine fueled for expansion.

Deal Negotiation & Dispute Resolution: We have taken hard-lined deals to the finish line and high-stakes cases to trial, so we know what it takes to win. We act swiftly to assess all options and chart a proactive path forward no matter the roadblock.

How Are We Different?

Why Choose SAGE for Your Build-to-Scale Business?

SAGE Business Counsel

Predictable Project-Based Billing

Regularly Scheduled Calls

Incentivized to Innovate

Systemized Processes

Proactive

Challenges the Status Quo

Typical Law Firms

Reactionary, Waits to be Called

Silos of Information, No teamwork

No Process, Incentivized to Spend

Traditional Billing Methods

Transactional in Nature

Preserves the Status Quo

SAGE Business Counsel

Proactive Support Before the Problem Arises

Team Focused and Holistic Service Model

Systemized Processes That Drive Efficiency

Flexible Invoicing and Payment Options

Relationship-Focused Raving Fan Culture

Challenges Norms to Achieve Results

Ready To UP-LEVEL YOUR LEGAL GAME?

Ready To Ditch The Legal Headaches?

Complete the Application

We work best with teams that value proactive planning and are commit to long-term strategic objectives. For this reason, we limit our client roster to ensure high alignment and success rates. Click below to see if we are the right legal partner for your company.

Meet Our Founding Attorney

Once your application is accepted, we will schedule a meeting between your company's key decision-makers and our Founding Attorney. At the end of the meeting, these leaders will decide whether to proceed with a formal engagement.

Strategy & Kickoff

The first step for all new clients is to prepare a Legal SWOT Analysis and Risk Audit so we can prepare a legal plan. All legal plans are customized to your company's risk profile, strategic goals, and most urgent priorities. Once we agree on a budget and deliverables, we get to work.

SAGE Best Supports Teams That:

Value advisors that provide tools and insights to scale with confidence

Leaders in construction, media, and SaaS committed to scaling their businesses responsibly

Seek a partnership with skilled legal professionals rather than one-off transactions

Organizations prioritizing legal compliance to build sustainable, legacy-driven enterprises

Ways We Can Support Your Business

Corporate and Business Law

General Counsel and Advisory Services

Subscription Legal Plans for Scale Ups

Mergers & Acquisitions - Buy and Sale Side

Brand & Intellectual Property

Trademark & Copyright Services

Licensing and IP Contract Management

Brand Portfolio Protection

Dispute Resolution & Lawsuits

Partner/Shareholder Disputes

Contract Disputes & Mediation

Collection/Commercial Litigation

Subscribe to Our Newsletter

Learn from real-world examples and gain inspiration from other business leaders. We shine a spotlight on successful practices and keep you informed about changing laws and legal trends.

SAGE Blogs

Stay ahead with our latest blogs covering business law, risk management, and strategic growth. Our expert insights help you navigate legal complexities with confidence. Ready to dive in?

SAGE Credo

At SAGE Business Counsel, we don’t just practice law—we challenge the norm, speak with candor, pursue intentional growth, and build freedom. We are more than attorneys, we're strategic allies committed to excellence and the legacy of those bold enough to dream big.

Frequently Asked Questions

Find Your Answers Here:

When does it make sense for my business to invest in a legal team?

Investing in a team of legal professionals makes sense for companies that have an internal leadership structure and are ready to scale, sell, or build a legacy.

What is the best first step if our business is facing a legal dispute?

Legal disputes can be disruptive and acting swiftly is paramount to a strong strategy but moving with haste will set you up for failure. The best first step is a case SWOT analysis to understand the investment and risk ahead before executing a course of action.

What does it mean to have a strategic legal advisor - aren't lawyers there for when the problem arises?

We believe in providing guidance and risk assessments to our clients before issues arise. Our tailored legal plans are designed to address your short and long term business objectives and provide you with actionable ways to protect your company from unnecessary risk and legal exposure.

What are the benefits of working with fractional general counsel?

Fractional general counsel services allow you to leverage the expertise of a legal team without the expense of a legal department. Having lawyers and paralegals to keep your company compliant will give leaders peace of mind to make bold moves in the marketplace.

Can we get a personalized legal plan from SAGE Business Counsel or is it one-size-fits all?

We tailor every legal plan to suit the unique opportunities and challenges of the respective client. Our goal is to provide a roadmap for success that you can use with or without us.

How can I get started with SAGE Business Counsel?

Connect with SAGE on Social Media:

Over a Decade Spent Protecting Business from Legal Pitfalls

At SAGE Business Counsel, we're different. Inspired by lean business and agile software development philosophies, we continuously refine our services to stay ahead of the curve. Founded in 2014, our innovative business law firm is dedicated to empowering leadership teams across the globe with strategic legal counsel. Whether you own the business or are on the leadership team, we can help companies succeed at every stage of growth.

LinkedIn

Instagram

Youtube

Facebook