5 SECRETS TO BUYING OR SELLING A BUSINESS FOR THE BEST PRICE AND TERMS

What does your exit strategy look like for your business? Whether you plan on buying or selling a business, it’s never too early to start preparing.

It can take several months to prepare a business for a sale, so if you want to get the best price and terms, you should understand the ins and outs of the business valuation process before you get started.

Keep reading for five secrets to buying or selling a business for the best price and terms.

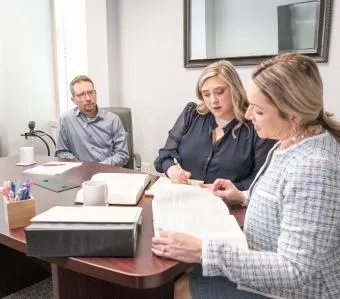

1. BUILD THE RIGHT TEAM FOR YOUR BUSINESS SALE OR PURCHASE

As most business leaders know, a strong team can maximize your profits. We learn to hire people who are smarter than us to streamline operations, build profitable products and deliver unparalleled customer experiences. The business valuation process requires lots of planning and patience. Here are 5 secrets to buying or selling a business for the best price and terms. The same goes for preparing your business for a sale, or acquiring another business. A proper business sale requires a wide range of advisors and experts, including, but not limited, to:

- Commercial lenders

- Business valuators

- Business attorneys

- CPAs

- Financial planners

- Business brokers

- Exit planning experts

- Estate lawyers

- Commercial real estate advisors or brokers

Business buyers and sellers shouldn’t make assumptions about which advisors are right for their deal. Rather, they should interview several different advisors to find the right fit for their unique situation. Ideally, business buyers and sellers will identify advisors who understand their industries and business size, among other key characteristics. Doing your homework and spending quality time interviewing and identifying advisors can also help you find advisors who have the right connections to get your deal done on the best terms.

2. START THE BUSINESS VALUATION PROCESS EARLY

A business valuation isn’t a one-and-done kind of project. Rather, a proper business valuation should be implemented during specific periods of time. Often, a business valuation will be conducted privately when the owner(s) first decide to consider selling, and later after the owner(s) make the necessary changes to get the best price and terms for their sale.

The second time around may occur privately by the sellers again, or by the buyer through their lender, for example.

As you can see, the business valuation process requires planning and patience. That’s why an early valuation is so critical. When starting sooner than later, a business valuation can identify value gaps that you and your team can correct to maximize the sales price.

3. BUYING A BUSINESS? DON’T RELY ON THE SELLER’S APPRAISAL

If you’ve ever purchased a home, you know the importance of getting an appraisal before submitting your offer in order to get the best deal possible. Business appraisals are just as important for buyers interested in purchasing a company.

Competing appraisals may prevent buyers from overpaying for a business by using the seller’s “hired gun” appraisal. Remember, the appraiser has duties to its client only — not to other parties in the deal. So, it’s in a buyer’s best interest to hire their own appraiser as well.

Money-Saving Tip: If the buyer is looking to finance the deal, then they will need to order an appraisal through their lender to avoid paying for an appraisal that the lender will not use. A lender will not accept a seller’s appraisal for funding purposes.

4. SELLING FOR MORE THAN $5 MILLION? BE AWARE OF THE SBA’S REQUIREMENTS

The Small Business Administration (SBA) only lends up to $5 million, so deals with larger sale prices will require cash, conventional lending, seller financing or other methods if the buyer wants to leverage an SBA loan.

The SBA also has very specific requirements for who it will lend to, what types of collateral is required, and the rules around seller earnouts. Buyers and sellers alike should ensure that they know these rules in the beginning of negotiations if the assumption is to fund with SBA-backed loans.

5. WORK WITH BUSINESS VALUATION EXPERTS YOU CAN TRUST

Building on Secret #1, it’s so important to hire a business valuation team that you can trust. Ask each advisor for their credentials, case studies and industry experience before signing contracts with them. They should understand everything about the type of business you’re purchasing or selling to position you for short-term and long-term success.

The business buying and selling processes can be lengthy and complex, so it’s also important to hire a team of advisors that align with your working style and schedule. Synchronizing your working styles and schedules can make for a smoother buying and selling experience, benefitting all parties (you, most importantly!) in the long run.

If you’re interested in buying or selling a business, send us a message to learn how we can support you in getting the best price and terms possible. Our business attorneys work hand-in-hand with trusted business valuation experts so you can get the most bang for your buck.

SAGE Newsletter

Learn from real-world examples and gain inspiration from business leaders. We shine a spotlight on successful businesses and entrepreneurs while also keeping you informed about legal trends.

SAGE Tips

from the Founder

Dive into our exclusive "Tips from the Founder" video series, where the heart and mind behind SAGE Business Counsel shares invaluable business insights and practical advice.

SAGE Workshops & Webinars

Watch our Workshops and Webinars. Engage with industry experts and gain actionable insights through our sessions to enhance your legal and business knowledge.

SAGE Frequently Asked Questions

Understanding the legal aspects of managing a business can be challenging. To make things easier, we’ve put together a comprehensive FAQ section to help you get familiar with our firm and the services we offer.

What is SAGE Business Counsel?

SAGE Business Counsel is a full-service law firm that provides legal services and consulting to small businesses.

What kind of legal services does SAGE Business Counsel offer?

SAGE Business Counsel offers a range of legal services, including Contract Review and Negotiation, Employment Law, Intellectual Property, Compliance and Regulatory Guidance, Litigation and Dispute Resolution, Business General Counsel, and more.

Can I get personalized legal advice from SAGE Business Counsel?

Yes, SAGE Business Counsel offers personalized service and support that's tailored to your business needs.

What should I do if the business is facing a legal dispute?

If a business is facing a legal dispute, it's recommended to seek legal advice from an attorney. SAGE Business Counsel can help you understand your options and navigate the legal process.

How can I protect my business from lawsuits?

There are several ways to protect your business from lawsuits, such as having clear policies and procedures, maintaining accurate records, and having liability insurance. It's also important to seek legal advice to ensure that your business is fully protected.

What are the benefits of working with a business attorney?

Working with a business attorney can provide several benefits, including legal advice and guidance, assistance with legal documents, representation in legal disputes, and peace of mind knowing that your business is legally protected.

How does SAGE Business Counsel differ from other law firms?

We take a client-first approach, prioritizing your success and building trust at every step. We believe in proactive legal counsel, providing guidance and risk assessment before issues arise. Our tailored legal plans are designed to address your specific business needs and goals.

How do I know SAGE is right for me?

At SAGE Business Counsel, we understand the challenges you face as a business owner. We simplify legal matters, translate legalese into clear terms, and ensure you stay compliant with all applicable laws and regulations.

Not all lawyers are created equal. At SAGE, we specialize in business law and have a proven track record of helping businesses like yours succeed. We're not just legal experts; we're trusted advisors who understand your unique business goals.

How can I get started with SAGE Business Counsel?

Take the first step towards legal peace of mind and business growth. Schedule an initial discovery call with our experienced attorneys today. We'll discuss your specific needs and develop a personalized strategy to help you achieve your goals.

We hope that these FAQs have been helpful in understanding more about SAGE Business Counsel. If you have any further questions or concerns, please don't hesitate to contact us.

Connect with SAGE on Social Media:

Over a Decade Spent Protecting Business from Legal Pitfalls

At SAGE Business Counsel, we're different. Inspired by lean business and agile software development philosophies, we continuously refine our services to stay ahead of the curve. Founded in 2014, our innovative business law firm is dedicated to empowering leadership teams across the globe with strategic legal counsel. Whether you own the business or are on the leadership team, we can help companies succeed at every stage of growth.

Facebook

Instagram

LinkedIn

Youtube